Q3 Mergers & Acquisition activity summary – Thames Valley region

Rockworth’s roundup of recent deals across the Thames Valley

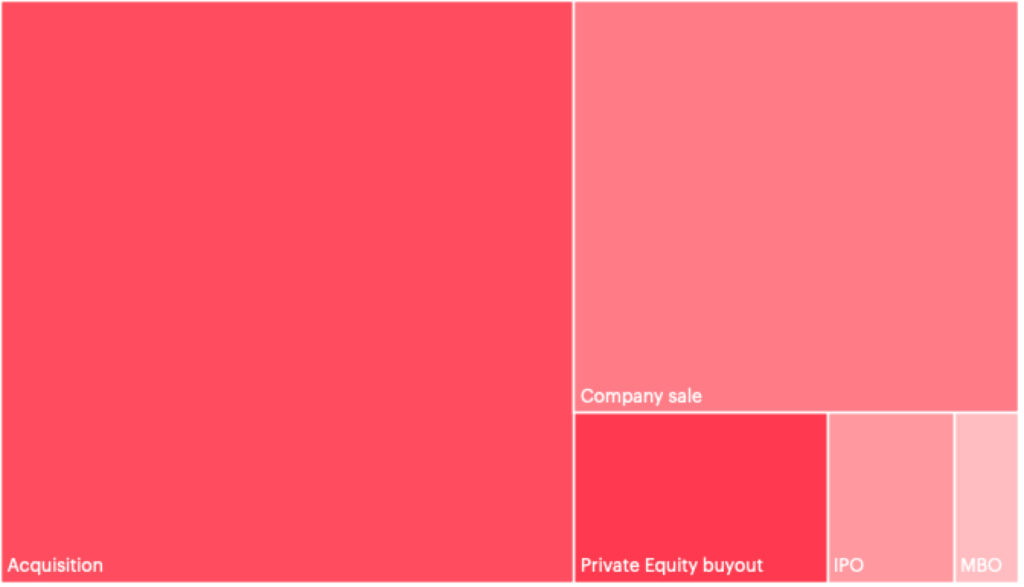

Q3 2021 was another busy period for M&A activity across the Thames Valley. Rockworth tracked 55 notable deals involving companies in the region between 1st July and 30th September. This included 17 company sales, four Private-Equity buyouts, one debt-funded MBO, 31 acquisitions and two IPOs.

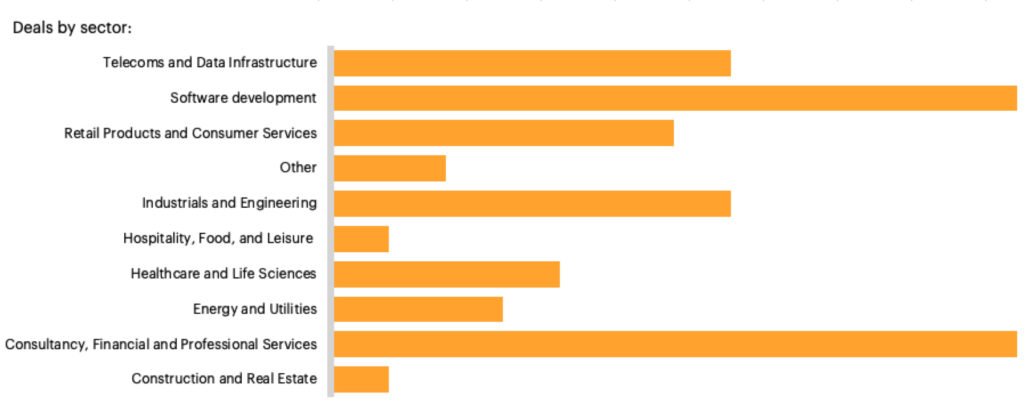

35% of deals involved technology companies, including software developers, telecoms specialists and data infrastructure providers.

Tech highlights included:

- Wireless Logic (based near Maidenhead) continued its international expansion with the acquisition of Milan-based Things Mobile.

- Halma (Amersham) acquired Ramtech Global, a wireless infrastructure provider based in Nottingham.

- Pulsant (Maidenhead) was sold to Antin Infrastructure Partners, by former owners Oak Hill Capital and Scottish Equity Partners.

There has been significant M&A activity in these sectors, partly because of the seismic shift towards doing business online and operating distributed workforces, accelerated by the Covid-19 pandemic. This trend is likely to continue for the foreseeable future, resulting in high levels of M&A activity well into 2022.

There were four prominent deals within Healthcare and Life Sciences – another sector for which the Thames Valley is well known. Oxford Nanopore Technologies hit the headlines in October with its IPO. The company’s turnover more than doubled in 2020, in part due to its ability to manufacture Covid-19 tests. After its first month as a public company, Oxford Nanapore’s market cap sits at around £4.3 billion.

Amongst smaller deals in the healthcare sector, the sale of Insignia Medical Systems stands out. Based in Basingstoke, Insignia provides software for capturing, storing and communication images from medical scanners. The business was acquired by Intelerad, a Canadian medical imaging business with more than 2,000 customers around the world.

Business-to-business service providers, including marketing consultancies, financial and professional services firms, accounted for 12 of the 55 tracked deals. Examples include The Marketing Practice’s acquisition of Omobono. Based near Oxford, The Marketing Practice’s combined group now employs 250 people across the UK, US, Germany and Australia.

Find out more

At Rockworth, we specialise in supporting the owners of private companies as they work towards growing and selling their businesses. Our approach is focused on maintaining confidentiality and creating a competitive bid process, designed to maximise sale values and ensure our clients’ businesses are in the right home for the next phase of their development.

If you are thinking of selling your company, either soon or in the coming years, we would love to hear from you. For a confidential conversation, just send us an email or book a short video appointment using the buttons below.