Packaging and Plastics M&A activity

Consumer trends and environmental regulation are combining to create an inflection point for UK packaging companies.

With fairly slow growth over the last five years that we see continuing over the next few years, it’s clear the trending ‘zero-waste’ culture has caused the landscape of the packaging market to change.

Growing awareness of environmental hazards and climate change means that consumers are demanding more recyclable materials and less waste, in turn putting pressure on retailers to use less packaging or focus on recycled and reusable materials. In 2017, Iceland announced that it would become the first major retailer to stop using plastic in its own brand products. This followed the announcement of government plans to end the use of non-essential plastic in the UK by 2042.

The migration away from single-use packaging has been hampered, however, by the low price of oil which has resulted in virgin plastics becoming cheaper.

Over the last few years the UK packaging market has grown slightly due to the strong export market (particularly for paper and card), attributed to the weakening of the pound following the Brexit referendum. Online retail orders and parcel deliveries have also kept this side of the market buoyant, where the lack of alternatives limits buyer power.

Investor Sentiments

Ongoing economic uncertainty has led investors to be more cautious when approaching deals.

However, after a disappointing performance in 1H19, Europe has enjoyed a relative recovery over the last few months, with the value of deals in 3Q19 reaching USD 166.5bn. M&A activity in the UK specifically has continued to experience higher transaction volumes over the last several years since 2016.

The UK & European Markets

In 2018 the UK packaging market had total revenues of £39,018m, reflecting a compound annual growth rate (CAGR) of 1.3% between FY2014 and FY2018.

The French market declined with a compound annual rate of change (CARC) of -0.6% to £18,450m in 2018, and our German counterparts saw the market increase with a CAGR of 1.8% to £48,697m over the same period. The United Kingdom currently accounts for 13.2% of the European packaging market, while Germany accounts for 16.5%.

Packaging consumption

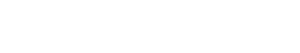

Figure: 2018 Global Packaging Market by Material Type

Market consumption volume increased with a CAGR of 0.9% between 2014 and 2018, to reach a total of 42.7 million metric tonnes in 2018. The market’s volume is expected to rise to 44.2 million metric tonnes by the end of 2023, representing a CAGR of 0.7% for the 2018-2023 period.

Increasing awareness about the impact of excessive waste on the environment has influenced consumer trends towards reusing and recycling. The rigid plastic segment was the market’s most lucrative in 2018, with total revenues of £21,615.8m, equivalent to 42.7% of the market’s overall value. The metal segment contributed revenues of £10,258.1m in 2018, equating to 20.3% of the market’s aggregate value.

Fragmented UK market

The leading incumbents DS Smith, Ball Corporation, Mondi and Crown Holdings are creating fierce price competition, consolidation through M&A and motivation for economies of scale. Additionally, there is a certain degree of backwards integration. The packaging market is often dictated by the demands of the supply chain, meaning price fluctuations can significantly impact profit margins. Scale or differentiation is required to continue operating in the market and both have been drivers for acquisitions in the mid-market players.

Manufacturing groups

Pat Chambliss, the executive vice president for M&A and corporate strategy at Novolex, the Carlyle Group owned manufacturer of packaging products, confirmed recently that they will use acquisitions to grow and broaden their product portfolio, and have not placed an upper or lower limit on deal size. Novolex have been active on both sides of the spectrum acquiring Zenith Specialty Bag, a US-based paper food packaging company at the low end, and purchasing Waddington Group in 2018 – including 16 sites in North America and Europe with 3,000 employees – at the top-end. While the focus remains on North America targets, it will look for European expansion in the coming year and have mentioned 8x EBITDA multiples as being a market average they would expect to pay for deals.

European Packaging Players

Numerous European packaging companies have also been on the acquisition trail. Notable deals in recent months include:

- THIMM Group, a German company manufacturing corrugated cardboard packaging products, which agreed to acquire ISL Schaumstoff Technik, a supplier of foam solutions, and ISL Verpackungstechnik an industrial packaging solutions provider on 17th October 2019;

- Zeus, a Dublin-based packaging group, which acquired two British packaging businesses, Van Der Windt and Smith Bateson, on October 1st;

- Berlin Packaging, a supplier of rigid packaging products which acquired Netherlands-based Vincap & Adolfse on 3rd September, and;

- AMB S.p.A., the Italian storage and packaging solutions provider, which acquired Thermodynamix Thermoforming Specialist Services Limited, a UK-based provider of PET, RPET and laminated rigid packaging.

Other European players continue to be vocal about their appetite for M&A, including the Finnish firm Huhtamaki whose CEO Charles Héaulmé conveyed earlier this year that they are on the lookout for “large acquisitions”. He mentioned that the company has a strong balance sheet that it is looking to deploy over the coming months. Similarly, the CFO Ken Bowles of Smurfit Kappa, the Irish-based packaging company, has said it is looking to spend c. €700m on acquisitions over the 2019-2020 period, specifically targeting home territories in Europe, but also in South America. They would prefer small bolt-ons that are easier to integrate, but will not shy away from larger deals having already acquired Reparenco in May 2019 for €460m, and Avala Ada for €133m.

Beyond Europe

There are definitely active buyers beyond the European continent. In Australia Pro-Pac Packaging’s CEO Tim Welsh has said he continues to focus on “[…] opportunities presenting […] acquisition synergies”. In South Africa Transpaco is also on the lookout for acquisitions, and in Canada IPL Plastics will “likely” pursue more deals following its purchase of Belgian firm Loomans Group.