Cash and deferred revenue in a SaaS business

What buyers will want to know about your business model and cash balance

Business owners who are selling their companies often expect the value of the cash on their balance sheet to be added to the final sale price. But for Software-as-a-Service businesses, the buyer may want to look at the cash balance in more detail.

It’s common for SaaS businesses to charge customers upfront on a quarterly or even annual basis. As a result, SaaS businesses can have lumpy cash flows, with their bank balance increasing significantly at various points throughout the year. But when a company receives an annual subscription payment, it also takes on a year-long commitment to provide a service. In one sense, the cash received is not fully earned until that year has fully passed.

Deferred revenue

To account for subscriptions correctly, your balance sheet should include a ‘deferred revenue’ liability. This represents the proportion of the subscription charges that relate to the months of service that have not yet been provided to the customer.

Here’s a simple example.

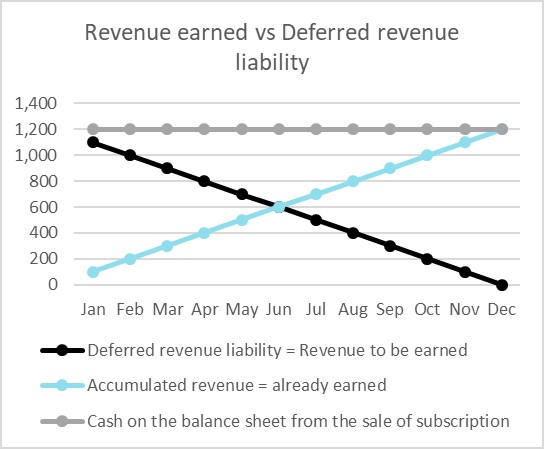

You are charging £1,200 for a yearly subscription running from January to December in advance. In January, your customer pays £1,200 to your bank account for the service. However, you have to deliver the service for the coming 12 months in order to have earned that money. If you happen to stop providing the service halfway through the year, your customer might demand his money back. To reflect this situation, you create a deferred income liability on the balance sheet in January and release this liability against revenue in the P&L on a monthly basis as you earn it. The amount of deferred liability for this service will be zero in December once the business has delivered the software to the customer for the full year.

The graph below shows how this works.

Agreeing the treatment of cash with a buyer

If cash and revenue have been accounted for as described above, it is relatively simple to work out the cash that should be attributable to the seller at the time of the transaction. The relevant amount will be the cash balance, less the deferred revenue liability.

This allows the seller to benefit from the cash relating to the proportion of the service that has already been provided. The buyer stands to benefit from the remainder, because they will have to provide the service to which the cash relates. That said, the cash that remains in the business (the ‘outstanding’ cash), should count towards any performance or earn-out targets set by the buyer. As such, the seller could eventually receive the cash at a multiple, rather than pound-for-pound on completion.

As with every situation, there is always room for negotiation and taking into consideration various elements of the service that is provided, as for example set up costs, consultancy or product customisation, different pricing structures, etc. which might enable the revenue to be recognised earlier and leave the opportunity for creating additional value for the Sellers when presented correctly.