There are several methods which can be used to value a business, some more theoretical and some more practical.

As most finance courses explain, the perfect method to value a business is known as Discounted Cash Flow (DCF). Here the future cash-flows generated from a business or project are calculated and discounted back to today’s values to account for inflation. This method should take into account both capital investment and any remuneration to staff and management; it assumes both a rate of inflation and a cost of capital related to the level of risk of the business as it grows in the future. Thus all factors are taken into account and in theory provides the most accurate way to value a business. However, as you will have noticed, this calculation requires a great deal of assumption and regardless of the complexity of the arithmetic, if discount rates, business growth or risk-free rates of return are incorrect (which they inevitably will be when talking about a meaningful length of time of say 5 years or more) the method proves difficult to justify when discussing private company sales. There is even an argument to say that M&A practitioners within major investment banks will come up with the desired result using ‘rules of thumb’ and adjust their assumptions accordingly.

How to value a business based upon its assets

With asset-rich companies and those making negligible profits the method to value a business would be to focus upon its net assets – both tangible in the form of property and machinery and intangible in the form of brand and intellectual property. With tangible assets there are established techniques for using comparables and the key question then is whether the various components are worth more together or separately – with loss-making businesses there may well be hidden value in separating various assets. A particularly interesting area involving intangible assets is related to brand valuation and, whilst our final comments below largely still apply, the specialist area has provided some interesting conceptual approaches to value a business which may be reliant on a well-known brand. See our piece on brand valuation for further discussion.

Common methods used to value a business

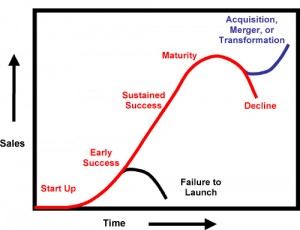

In reality, the cliché still applies that a business is still only worth what a willing buyer is prepared to offer at a single point in time – values of businesses are transient and not only change with economic climate, trading performance and competitive tension but can disappear entirely. Where the corporate finance community and buyers and seller’s perspective it is important to be aware of the various methods buyers might be using to calculate potential synergies and values but more important is the generation of a real ‘market’ of potential interest for your business. From a buyer’s perspective there will be certain synergies that we are not prepared to share with the seller but equally it is important to provide a logical basis from which we can justfy our approach to a potential vendor. A sound logic provides basis for doscussion and helps avoid the ‘positional bargaining’ that can be the end of sensible negotiations. Most typically those who have to value a business on a regular basis rely on a multiple of profit – typically EBITDA – for an explanation please see our note on EBITDA multiples.